Prognosis for 2024

what are our predictions for healthcare in 2024, ranging from how $ is being allocated, if data & AI solutions will meet expectations, and just where health systems fit into the equation

Investing

Funding environment will continue to be challenging

Since 2021, the fundraising environment has softened leading to less dollars flowing into early-stage healthcare companies. According to CB Insights, digital health companies raised $52.7B globally in 2021, and this figure decreased to $13.2B in 2023. Alongside the drastic decrease in funds raised by these companies, the absolute number of companies that raised capital was also cut in half. Companies that struggled to raise capital in 2023 were challenged with the task of extending their cash runways and raising extensions, unlabeled, or silent rounds. This year, we expect investors to continue to remain cautious when deploying capital within the digital health sector.

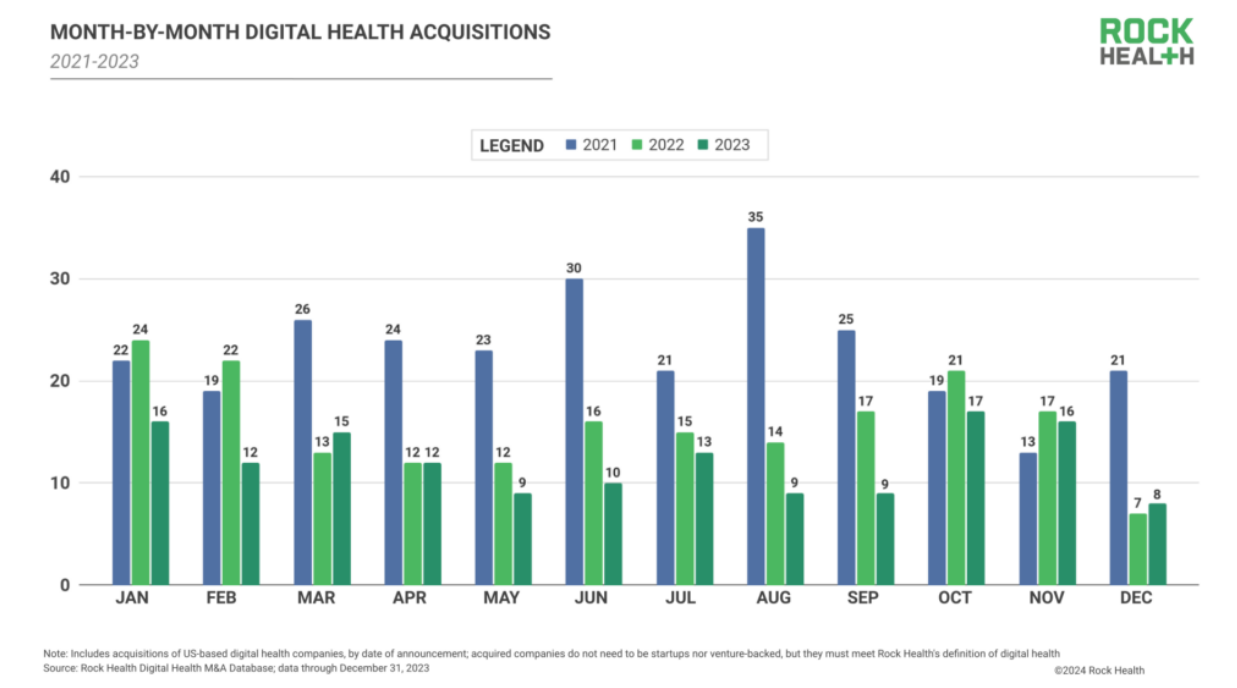

M&A and bankruptcy

The past several years have been filled with the emergence of countless digital health companies that have been created within competitive spaces of the market. The flood of new businesses who are competing for both customers and capital has caused many of them to struggle, pivot their strategy, or cease to exist. In 2023, three large health tech companies declared bankruptcy – Babylon Health, Pear Therapeutics, and Health IQ. These three companies had raised a combined $1.7B+ in capital, and Babylon and Pear had attained unicorn status. We expect this trend to extend into 2024 as companies of all sizes struggle to raise capital and are forced to either cease operations or be acquired by larger businesses at valuations lower than their last raise. Separately, M&A in 2024 may be fueled in part by decreasing interest rates resulting in a more favorable dealmaking environment than in recent years. AI is also set to play a key role in driving M&A, as companies look to incorporate new technology into their existing business models without hiring talent attempting to build capabilities in house.

Election year topics of interest

Given 2024 is a presidential election year in the U.S., we expect digital health companies to address issues that are top of mind for Americans. According to KFF, the top concerns American voters are interested in hearing about this election season include inflation, affordability of health care, the future of Medicare and Medicaid, and access to mental health care. Venture backed companies targeting price transparency (e.g., Turquoise Health), Medicare and Medicaid populations (e.g., Cityblock), and mental health (e.g., Lyra Health) stand to benefit from increased public and political attention on these issues. Additionally, companies that are building in this space potentially stand to benefit from from favorable regulation pending the outcome of the election.

Data and AI

2023 was a year of pontification for the industry. “We should do this,” “wouldn’t it be cool if,” “let replace this process with X tech.” These were the statements thrown around board rooms, pitched to investors and discussed (at length) at many industry events. 2024 will be where the rubber begins to meet the road (at high speed). Companies and implementers alike will be judged on how well they execute on the promises of last year's dreams. Those who successfully execute the three predictions below will be positioned extremely well to make good on last year’s promises and deliver on their dreams.

Model distillation

As the utility of large language models (and generative AI more broadly) is being proven out across industries, implementers are starting to learn firsthand how expensive it can be to run inference on these extremely large models on specialized hardware (GPUs). Companies are trying to “fix” this problem by engineering around it, in the form of inference endpoints that can be “scaled to zero.” This basically means that the underlying API serving architecture is scaled down to zero (or near zero) when not being used. As you can imagine, this causes its own set of problems related to “cold starts” when spinning the endpoint back up. Personally, our beliefs are that the only real way to “fix” the size problem engrained in these models is to just make them smaller. The process for reducing these model sizes is called distillation. Companies are actively tackling this problem (Microsoft Knowledge Distillation, Snorkel) and the open source and research communities are responding with frameworks (Distilling Step-by-Step!, Knowledge Distillation of Large Language Models) to help them do so. Now, questions related to the tuning, generalizability and overall knowledge breadth of these “smaller models,” are beginning to crop up. Even still, we are VERY bullish on model distillation being the future here. If you use hardware as a case study, this “release large and iterate to a smaller form factor” strategy can be seen repeatedly and is still happening to this day! This, to us, seems like an obvious path forward for the field, making these models more accessible for implementations and giving way to new architectures leveraging these small models (see: AI Agent Frameworks).

Investing in data foundations

As companies start to jump on the “AI bandwagon” attempting to remain relevant in a market that seems to require the use of AI in your marketing materials, leaders are started to become aware of the duct-taped, excel backed data infrastructure that is currently in place. In fact, 76% of companies are concerned their current infrastructure will be unable to scale to meet upcoming demands (source). They are finally starting to realize that building STRONG data foundations is a mandatory step to operating effectively in the AI / ML space and the technology space more broadly. As the old saying goes, garbage in garbage out. Up until now, you could argue (and I’ve seen it done) that the currently in place spider web of “infrastructure” is enough to get started and experiment with machine learning. Nowadays, technology is moving too quickly to neglect the crucial underpinning of a modern data platform. Because of this, companies building data foundation tech, products, and platforms will see a boom in popularity (maybe we even see a Databricks IPO?!), teams will start to focus heavily on getting this right, and the teams / companies that do will operate at a rate simply unattainable by those who don't.

Natural language proliferation (prompt to code, ambient listening / transcribing)

This one is a bit hand-wavy even for a predictions piece, but we firmly believe that natural language will beat out all the shiny new toys being released as we speak (no pun intended – although that may be hard to believe) and prove to be the most valuable tool for humanity in the years to come. Ambient listening technology, transcription models, and generative models are all now at a stage where we believe it is safe to say the ability to communicate clearly will prove to be a human’s most important skill. This has long been a coveted skill, spanning across industries; however, it has largely sidestepped the technology world. This will be the year where people who can clearly and concisely convey their thoughts will excel at the task at hand. Examples of technology leveraging natural language are all over the place, with Github Copilot and other code generation tools (Databricks Assistant, OpenAI Codex, Vertex AI), Nuance’s ambient listening technology (Dragon Ambient Experience) rivaled by many other competing companies, and OpenAI’s Whisper API, which competes with a transcription market that seems to be growing every day. Now to be clear, we are not predicting that natural language will replace skills like writing code, but simply that the opportunity to use natural language to help augment many of these tasks will explode this year.

Ignoring these three predictions and carrying on with last year’s mindset will not end well. Complacency will leave this cohort in the dust of those who have made strides towards successful execution of the above.

Health Systems

What even is a health system?

The idea of what a healthcare provider provides has drastically evolved and shifted over the years. Health systems have become far more than a doctor’s visit. Systems across the country are performing key research, acting as incubators and accelerators, forming partnerships and joint ventures with payers, labs, and MedTech companies, and implementing self-insured employer models. Health systems are more and more establishing themselves as pillars of the community, offering community health services and focusing on expansion rather than consolidation of resources.

We predict that the definition of a hospital will become even more flexible and versatile in 2024. Payvider models will become more common, health systems will no longer be the place you go to for care but the place that brings care to you wherever you go, with increased focus on telehealth, remote patient monitoring, and care navigation, and hospitals will have to embrace becoming pilot sites for innovation and care delivery. In doing so, we’ll see the traditional health system model systematically morph into something entirely new.

Health systems will diversify revenue streams and incentivize workforce however they can

Health systems have seen a substantial lack of financial stability over the last few years, experiencing slow yet fluctuating increases in revenue coupled with higher operating expenses and a need to bridge that gap in order to meet margins. In an effort to simultaneously take risks and cut costs, we foresee health systems exploring alternative revenue streams while grappling with questions of how to bring more people into the clinical profession. Hospitals are taking note of the treasure trove that exists within their EHRs and exploring ways to monetize that data while still being cognizant of patient privacy. Speaking of data-centric partnerships, whether its Mayo Clinic individually partnering with both Google Cloud and Microsoft for deploying AI solutions, Northwestern Medicine leveraging Microsoft Fabric, Atrium Health utilizing Nuance’s DAX™ Copilot, or NYU Langone deploying internally developed LLM, NYUTron, hospitals are pushing and will continue to push towards implementing innovative technological solutions, embracing cloud agnostics and interoperability, and incorporating technology from external and internal sources. Many health systems across the country have also established investment arms as a way to further enrich their revenue streams while also bringing cutting edge solutions to their health systems.

All that being said, a huge factor in the financial precariousness of health systems is the increasingly burnt out and dwindling workforce, particularly pronounced by the nursing shortages and strikes seen throughout 2023. Many nurses and physicians are making career changes due to myriad issues, including salary constraints, excessive workloads and hours, and general burnout, only enhanced by the COVID-19 pandemic. Nursing students are also dwindling, with faculty shortages and underfunded programs. Without substantial efforts put into place to address these clinical staff shortages, patient care will without a doubt suffer. Health systems will need to focus on retention plans, including providing employee wellness services, increased pay, and encouraging and fostering diversity in nursing and medical school programs. In an intriguing and creative move, it was recently announced that Bloomberg Philanthropies would be supporting an effort to create healthcare-focused high schools. Ten schools will be opened across the country with paid internship opportunities at partner hospitals, with the goal of encouraging students to pursue careers in healthcare. Hospital partners are also committing to subsidizing tuition for ongoing education and providing job opportunities post-graduation. Outside-the-box solutions like these, which have the potential for long-term impact, will be what has the potential to make a significant difference in addressing these staffing shortages.

To be or not to be (moving towards VBC)

The promise of value-based care has lingered upon us for a while now. The reality is, while we have seen strides in this space, we have a long way to go. Programs such as the Medicare Shared Savings Program (MSSP) and the CMMI (CMS’s Center for Medicare and Medicaid Innovation) have enabled ACOs to develop improved care plans and to explore alternative payment models (APMs). While the focus has largely been on primary care, there will certainly be more emphasis on specialty care VBC efforts in 2024. Since the Affordable Care Act (ACA) passed in 2010, we have been moving (crawling) towards a system in which reimbursement is tied directly to improved quality of care. Improving care delivery and patient experience should be the driving factors in how we finance healthcare. In order to make genuine progress in transitioning from fee-for-service, the underlying infrastructure put in place to assess, qualify, and quantify quality of care needs to and likely will see improvements in 2024. There isn’t going to be a massive miraculous shift from FFS payment models in the coming year, but what we can expect is that advancements in technology and data infrastructure across health systems and payers alike, will help to ensure we are appropriately tracking outcomes, facilitating care navigation, and continuing to lay the necessary groundwork to support VBC initiatives in the coming years.

Buyer beware

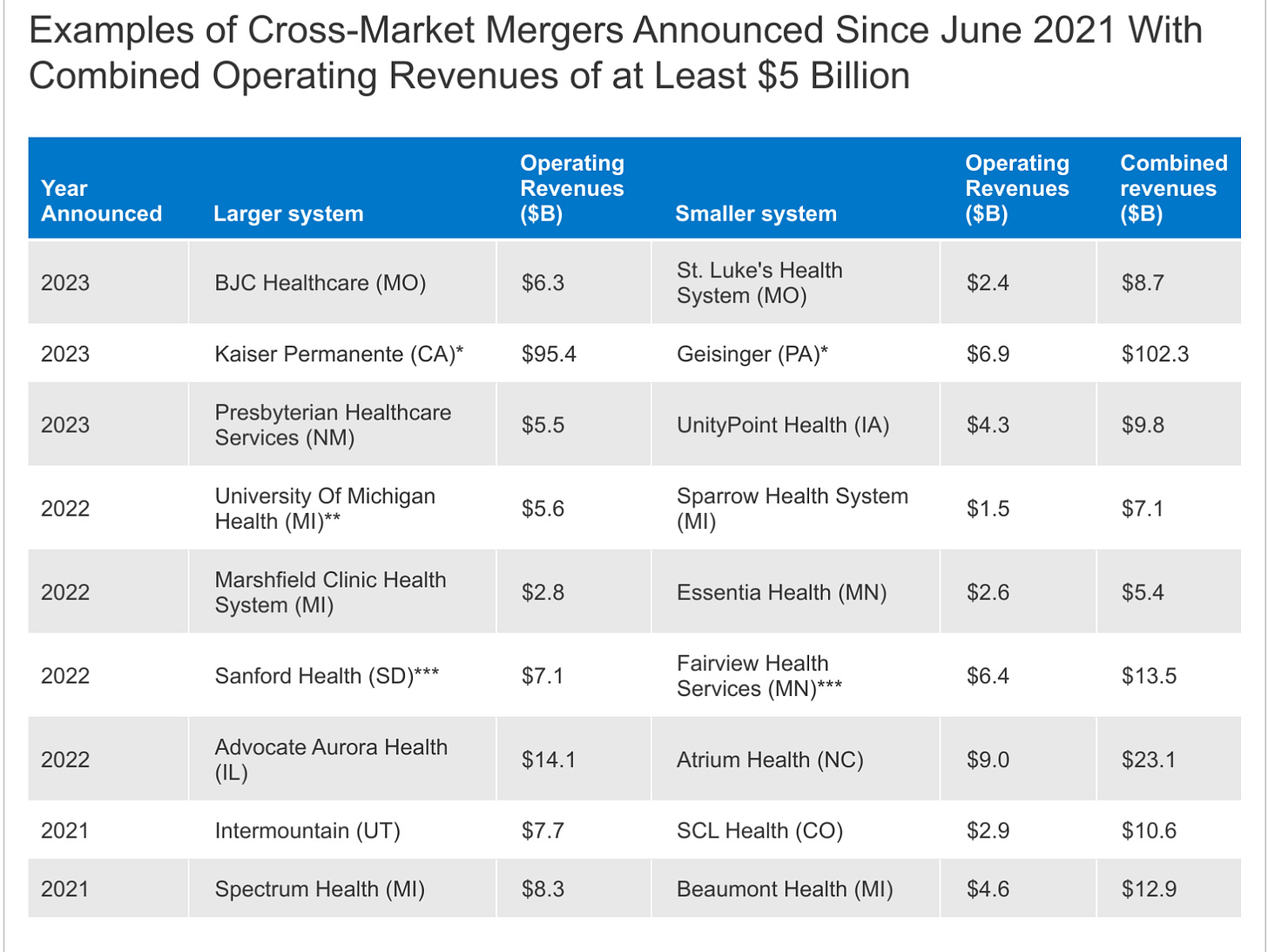

2023 saw a slew of health system M&A deals that raised eyebrows and turned heads. Hemant Taneja took the stage at HLTH 2023 after Nick Jonas and ended up being the one to put on a show. He announced that General Catalyst was launching Health Assurance Transformation Corporation (HATCo), to be led by Dr. Mark Harrison, former CEO of Intermountain Healthcare. They made the bold statement that HATCo would be buying a health system within its first year of operation, and lo and behold, a few months later, HATCo announced its intention to acquire Summa Health out of Akron, Ohio. Much like health systems stretching the bounds of what they can do, VC firms are now signaling the same.

In that same vein, there were a number of other health system acquisitions that made headlines throughout the year. Kaiser Permanente announced their plan to acquire Geisinger Health. Kaiser, owner of 40 hospitals and 618 medical facilities is no stranger to acquisitions, establishing through this initial acquisition, the foundation for Risant Health, their value-based care non-profit organization that intends to acquire four to six more health systems over the next five years, with about $5B allocated to support these efforts. Throughout the year, mergers and joint ventures such as that between Henry Ford Health and Ascension Michigan as well as BJC HealthCare & St. Luke’s Health System were announced. In a bit of a reality check for what was otherwise a series of bold M&A deals coming to fruition, Presbyterian Healthcare Services and UnityPoint Health announced intent to merge and then subsequently announced the merger was being called off. Simply put, the expectation for 2024 is that we’ll being seeing a lot more of this. Announcements will be made for cross-market mergers between health systems or acquisitions (Risant Health seems confident they’re making at least one a year) with the goal of more integrated healthcare models across the US, and inevitably, not every effort will pan out. That being said, we’re excited to see 2024 be a year of matchmaking.

Final Thoughts

To close things out, we decided to make some truly outrageous yet extremely plausible final predictions. Let us know in the comments if you agree, disagree, or have some outlandish predictions of your own! We’ll be checking back on these predictions in December 2024 to either bask in our intuitive prowess or double down for 2025!

Matt – There will be a sizable uptick in direct-to-consumer personalized care delivery – operating on the bleeding edge of AI-assisted care. You will see companies already operating in the space grow 50% or greater, with digital health companies and health systems alike pivoting into this space.

Brittany – A digital health unicorn that was once viewed as the market leader in its space will either be dissolved or acquired for less than 25% of its previous valuation.

Ipsita – Despite claims that this is a single health system proof-of-concept purchase, before year end, HATCo will announce its intention to add another health system to its network; meanwhile, Risant Health will launch a venture arm.

Very well articulated dissection of healthcare in this country in this discussion. Look forward to AI taking out the 'for profit' health insurance companies and allocate more equitable flow of resources between patient, doctor and hospital. Reigning in the ridiculous markups in in-patient care hospital invoices and taking out the middle man insurance companies are the essential first steps toward better patient care and retaining more doctors and nurses with better pay. The goal is to make healthcare affordable and ultimately free. Taxpayer money does fund research in big pharma. Paying again for care you have technically already paid through taxes seems wrong. Double dipping is never a good idea, be it a condiment at a party or a patients' wallet receiving medical care. Congratulations on another great article!

Considering one of the criticisms of VBC is increased administrative workload, it'll be interesting to see how genAI can be used to reduce those concerns.